Mastering NY Income Tax: A Comprehensive Guide For Every New Yorker

Let’s talk about something that affects every single resident of the Empire State—New York income tax. Whether you’re a seasoned professional or just starting your career, understanding how NY income tax works is crucial. It’s not just about paying what you owe; it’s about maximizing your take-home pay and staying compliant with the law. So, buckle up because we’re diving deep into the world of New York income tax, one step at a time.

Now, I know what you’re thinking—taxes are boring, right? But hear me out. This isn’t just another dry, complicated guide. We’re breaking it down in a way that’s easy to follow, packed with actionable tips, and maybe even a little entertaining. Because let’s face it, life in the Big Apple is already stressful enough without adding tax confusion to the mix.

By the end of this article, you’ll be equipped with the knowledge you need to navigate NY income tax like a pro. Whether you’re filing for the first time or looking to refine your strategy, this guide’s got you covered. So, let’s get started, shall we?

Read also:Life Partner P Allen Smiths Wife Debbie A Wikipedia Journey You Wont Forget

Understanding NY Income Tax Basics

First things first, let’s break down the basics. New York income tax is a state-level tax that applies to individuals, businesses, and trusts earning income within the state. It’s separate from federal taxes but works alongside them to determine your overall tax liability. Think of it as a partnership—your state and federal taxes working together to fund public services like schools, roads, and healthcare.

Now, one thing to keep in mind is that NY income tax rates vary depending on your income level. It’s a progressive system, meaning the more you earn, the higher the rate you pay. But don’t worry, we’ll dive deeper into those rates in just a bit.

Who Needs to Pay NY Income Tax?

Not everyone living in New York has to pay state income tax. Generally, if you’re a resident of the state and earn above a certain threshold, you’re required to file. But what about non-residents who work in New York? Yep, they’re on the hook too. If you work in the state, even part-time, you might still owe NY income tax. Let’s break it down further:

- Residents: If you live in New York for more than 183 days in a year, you’re considered a resident and must file.

- Non-Residents: If you work in New York but don’t live there, you’ll need to file a non-resident return.

- Part-Year Residents: If you moved in or out of the state during the year, you’ll file as a part-year resident.

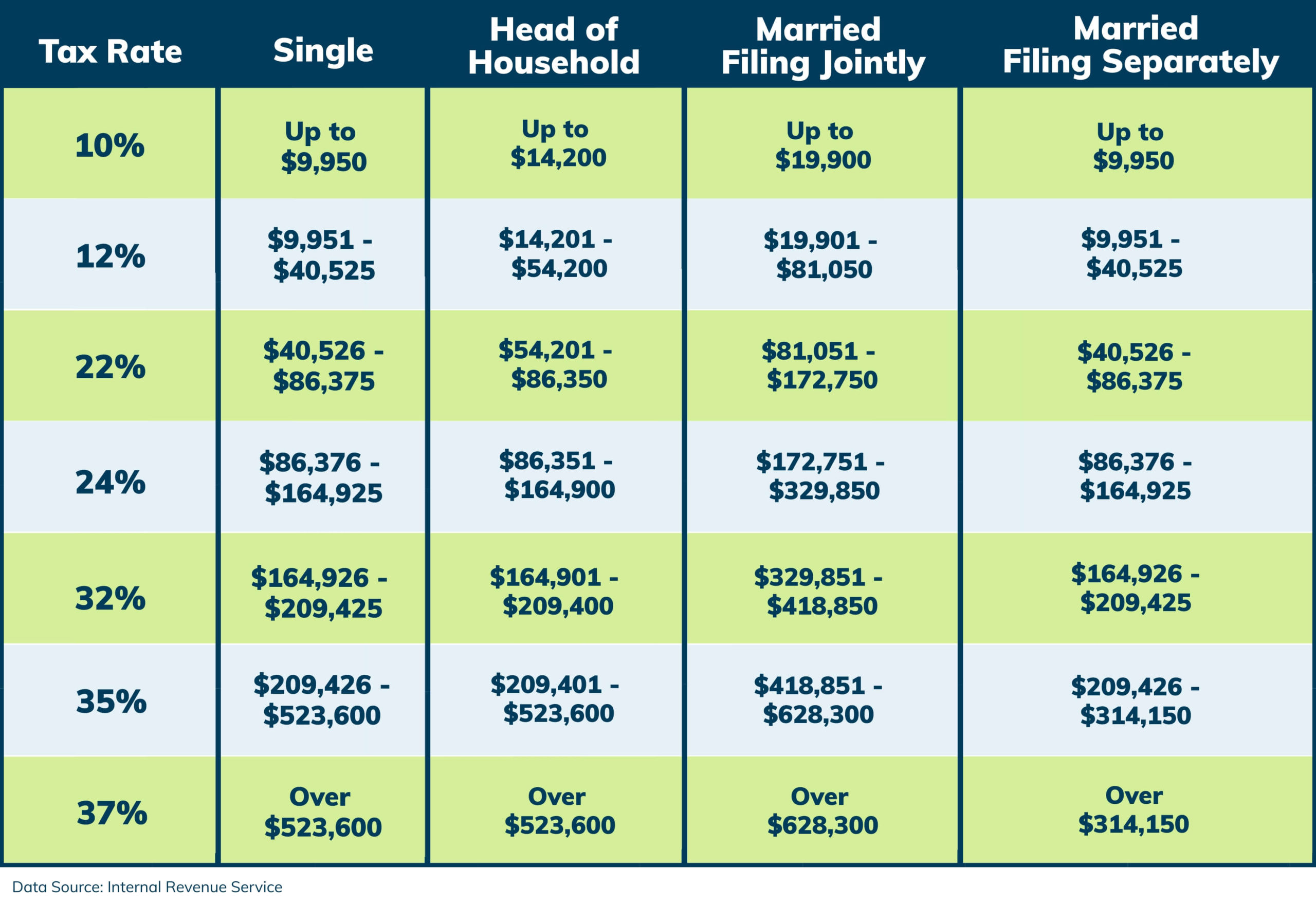

NY Income Tax Rates Explained

Alright, let’s talk numbers. New York’s income tax rates range from 4% to 10.9% depending on your filing status and income level. Here’s a quick rundown of the current brackets:

- Single Filers: The lowest rate of 4% applies to income up to $8,600, while the highest rate of 10.9% kicks in for income over $25 million.

- Married Filing Jointly: The brackets are slightly higher, with the top rate applying to income over $30 million.

- Head of Household: Similar to single filers but with slightly higher thresholds.

Now, these rates can feel overwhelming, but remember, you’re only taxed at the higher rate for the portion of your income that falls within that bracket. So, if you’re in the 6.45% bracket, only the income above the previous threshold is taxed at that rate. Makes sense, right?

How Do These Rates Compare Nationally?

When it comes to state income tax, New York is on the higher end of the spectrum. States like Florida and Texas don’t have any income tax at all, while others, like California, have even higher rates. But here’s the good news—New York offers a variety of deductions and credits that can help lower your tax bill. We’ll cover those in a bit.

Read also:Bollyflix Pro Your Ultimate Destination For Bollywood Entertainment

Key Deductions and Credits to Know

One of the best ways to reduce your NY income tax liability is by taking advantage of deductions and credits. These are essentially financial perks the state offers to help ease the tax burden. Here are some of the most common ones:

- Standard Deduction: This is a flat amount you can subtract from your income before calculating your tax. For 2023, it’s $8,600 for single filers and $17,200 for married couples filing jointly.

- Itemized Deductions: If you have significant expenses like mortgage interest or medical bills, you might benefit from itemizing instead of taking the standard deduction.

- Child Tax Credit: If you have kids, you might qualify for a credit that reduces your tax bill dollar-for-dollar.

- Property Tax Credit: Homeowners can claim a credit based on their property taxes paid.

These are just a few examples. Depending on your situation, there might be other deductions and credits available to you. Always consult with a tax professional to make sure you’re maximizing your savings.

What About Federal Deductions?

It’s worth noting that many federal deductions and credits also apply to your NY income tax return. For example, if you itemize on your federal return, you can usually carry those same deductions over to your state return. It’s all about finding the best strategy to minimize your overall tax liability.

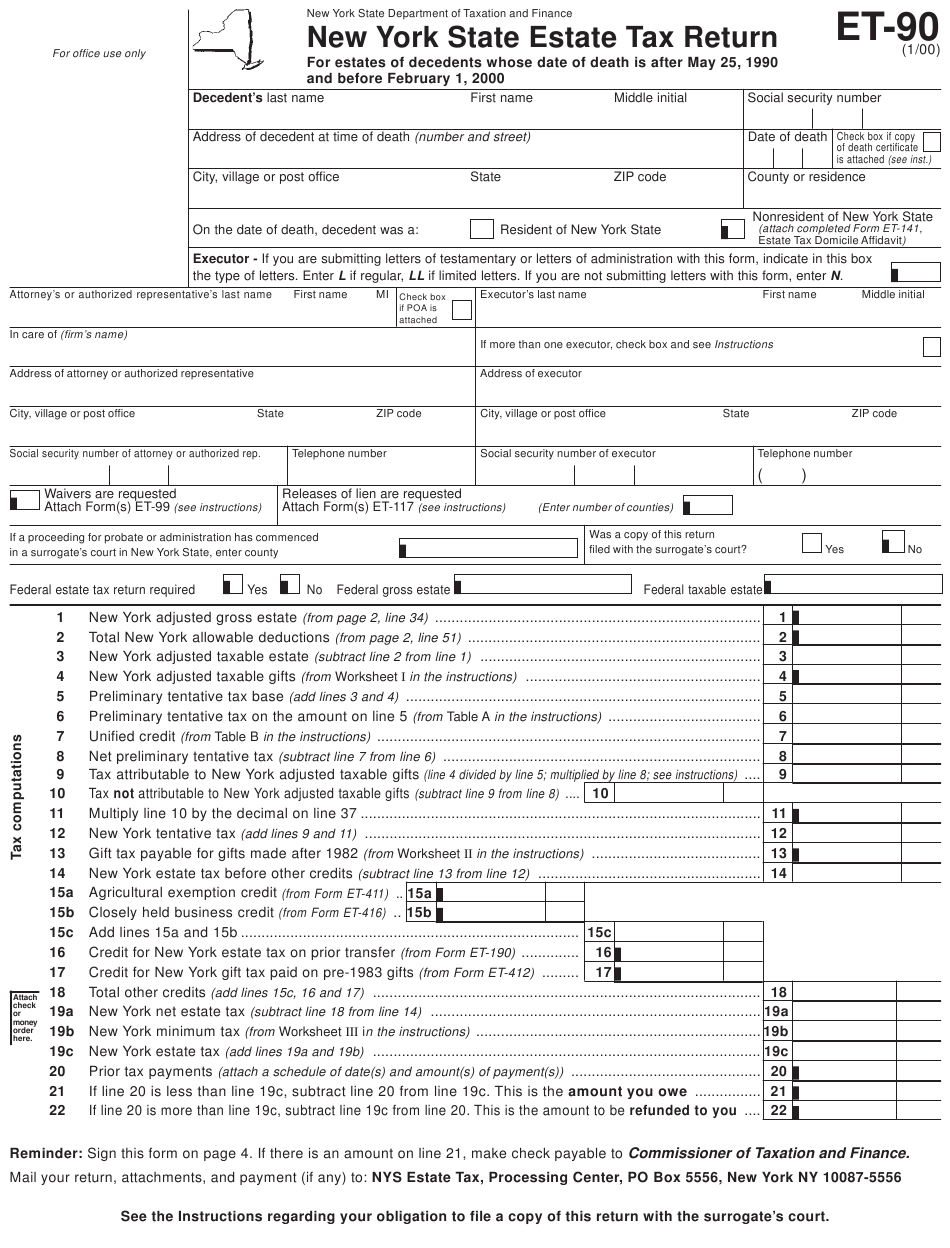

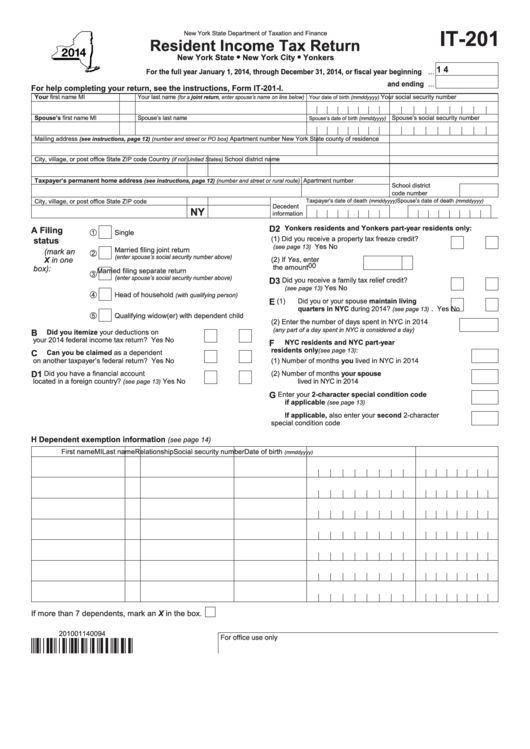

Filing Your NY Income Tax Return

Now that we’ve covered the basics, let’s talk about the actual filing process. Most people file their NY income tax returns online using software like TurboTax or H&R Block. But if you prefer the old-school method, you can still file on paper. Just make sure to double-check everything before submitting.

One important thing to keep in mind is the deadline. For most taxpayers, the deadline is April 15th. If that date falls on a weekend or holiday, it might be extended by a day or two. But don’t rely on that—always aim to file early to avoid last-minute stress.

Tips for a Smooth Filing Process

Here are a few tips to make the filing process as smooth as possible:

- Gather All Necessary Documents: Before you start, make sure you have all your W-2s, 1099s, and other tax documents in order.

- Double-Check Your Numbers: Mistakes can lead to delays or penalties, so take your time and review everything carefully.

- Consider Professional Help: If your taxes are complicated, it might be worth hiring a tax preparer or accountant. The peace of mind is worth the cost.

Common Mistakes to Avoid

Even the most experienced filers make mistakes from time to time. Here are some common ones to watch out for:

- Missing Deductions: Don’t leave money on the table by forgetting to claim deductions you’re entitled to.

- Incorrect Social Security Numbers: Double-check that all SSNs on your return are accurate.

- Forgetting to Sign: Sounds silly, but it happens more often than you’d think. Make sure your return is signed and dated before submitting.

By avoiding these pitfalls, you can ensure a smoother filing process and reduce the risk of errors or delays.

How to Correct a Mistake

If you do make a mistake, don’t panic. You can file an amended return using Form IT-201-X. Just make sure to include any additional documentation and explain the changes you’re making. The sooner you address the issue, the better.

NY Income Tax and Self-Employed Individuals

If you’re self-employed, the rules for NY income tax can get a little more complicated. Not only do you have to pay regular income tax, but you also have to pay self-employment tax to cover Social Security and Medicare. This can add up quickly, so it’s important to plan ahead.

One way to ease the burden is by setting aside money throughout the year for taxes. Many self-employed individuals use a separate savings account for this purpose, making it easier to pay their quarterly estimated taxes without breaking the bank.

Tax Deductions for Self-Employed Filers

Fortunately, there are plenty of deductions available to self-employed individuals. Some of the most common ones include:

- Home Office Deduction: If you work from home, you might qualify for this deduction based on the percentage of your home used for business.

- Travel Expenses: Business-related travel costs, like gas and lodging, can often be deducted.

- Health Insurance Premiums: If you pay for your own health insurance, you can deduct the premiums from your income.

Again, it’s always a good idea to consult with a tax professional to make sure you’re taking full advantage of all available deductions.

NY Income Tax and Retirement Planning

Finally, let’s talk about how NY income tax affects your retirement planning. If you’re contributing to a traditional IRA or 401(k), those contributions are typically tax-deductible, which can help lower your current tax bill. But keep in mind that withdrawals in retirement will be taxed as ordinary income.

On the flip side, contributions to a Roth IRA or Roth 401(k) aren’t tax-deductible, but the withdrawals in retirement are tax-free. It’s all about finding the right balance based on your current financial situation and future goals.

Tax Strategies for Retirement Savers

Here are a few strategies to consider when planning for retirement:

- Maximize Contributions: The more you contribute now, the less you’ll owe in taxes and the more you’ll have in retirement.

- Consider Tax-Deferred Accounts: These can help reduce your taxable income in the short term.

- Plan for Required Minimum Distributions: Once you reach age 72, you’ll need to start taking withdrawals from certain retirement accounts, so plan accordingly.

Conclusion

So, there you have it—a comprehensive guide to mastering NY income tax. From understanding the basics to navigating deductions and credits, we’ve covered everything you need to know to file confidently and save money. Remember, taxes don’t have to be scary. With a little knowledge and preparation, you can tackle them head-on and keep more of your hard-earned cash.

Now, here’s your call to action: take what you’ve learned and put it into practice. Whether that means gathering your documents for this year’s return or starting to plan for next year, every step you take is a step in the right direction. And if you have any questions or need further clarification, feel free to leave a comment below or reach out to a tax professional.

Thanks for reading, and happy filing!

Table of Contents

Article Recommendations